Filing your taxes can be a complex process, and waiting for your refund can be even more stressful. If you're wondering, “Where's my refund?,” you're not alone. The Internal Revenue Service (IRS) provides several tools and resources to help taxpayers track their refund status. Here’s a comprehensive guide to understanding and navigating the IRS refund process.

First, it's important to understand that the IRS processes refunds in a structured manner. According to the IRS, you can expect to receive your refund within 21 days after e-filing. However, this timeline can vary based on several factors, including the complexity of your return and the accuracy of the information provided. If you've filed a paper return, the processing time can be significantly longer, often taking several weeks or even months .

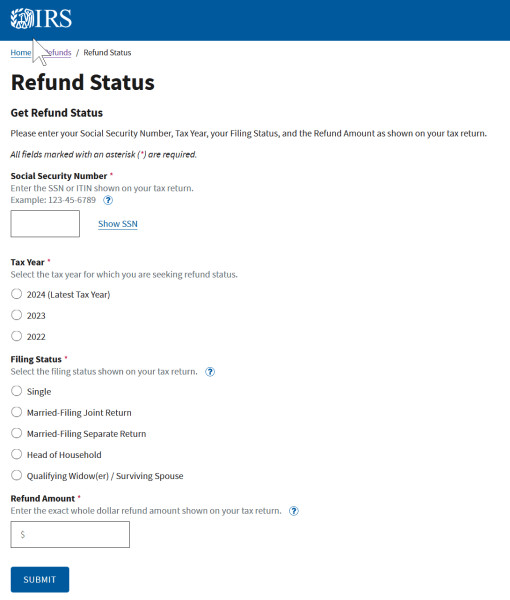

To get the most accurate and up-to-date information on your refund, the IRS offers the “Where’s My Refund?” tool. This online resource allows you to check the status of your refund in real-time. You can access it through the official IRS website. To use the tool, you will need to provide your Social Security number (SSN), your filing status, and the exact refund amount shown on your tax return. The tool will then provide you with one of three messages: “Return Received,” “Refund Approved,” or “Refund Sent.” Each message gives you a different level of assurance about the progress of your refund .

If you’re experiencing delays or have specific concerns, it’s important to consider a few common issues. Errors in your return, such as incorrect banking information or missing forms, can significantly delay the processing of your refund. Additionally, if your return is selected for further review or audit, the IRS may take additional time to process your refund. In such cases, the IRS may contact you for more information, so it’s important to respond promptly to avoid further delays. Sometimes, the IRS may issue a notice to you to inform you of any changes or issues with your return .

For those who prefer a more direct approach, the IRS also offers a phone service to check your refund status. You can call the IRS Refund Hotline at 800-829-1954. However, it’s important to note that wait times can be long, especially during peak tax season. The IRS also provides a mobile app, IRS2Go, which allows you to check your refund status on the go. This app is particularly useful for those who prefer to manage their finances from their smartphones .

In summary, tracking your refund with the IRS can be straightforward if you know where to look. Utilizing the “Where’s My Refund?” tool, checking the IRS website, or using the IRS2Go app can provide you with the information you need. If you encounter any issues or delays, it’s crucial to stay informed and respond promptly to any IRS requests for additional information. By staying proactive, you can ensure a smoother refund process.