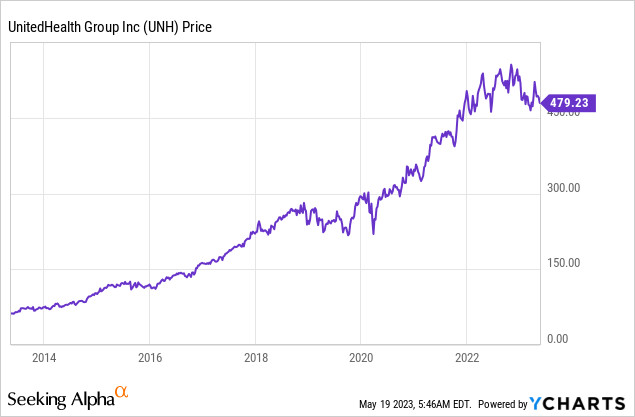

UnitedHealth Group Incorporated (UNH), a titan in the healthcare sector, has seen significant fluctuations in its stock performance over the past months. This volatility comes as the company faces a range of challenges, from earnings reports to broader market trends. Investors and analysts are closely monitoring the situation as they weigh the company's future prospects in an ever-evolving healthcare landscape.

UnitedHealth Group traded at $355.02 per share, with a market capitalization of a substantial $256.07 billion, reflecting its dominance in the healthcare industry. The stock's price-to-earnings (P/E) ratio stands at 18.35x, indicating a moderate valuation relative to its earnings.

### Volatility and Earnings Concerns The company’s recent earnings report has been a significant factor in the stock's performance. UnitedHealth's revenue guidance for 2026 was seen as soft, with the company forecasting adjusted earnings of more than $17.75 per share. This guidance, combined with broader market volatility, contributed to a 20% plunge in the stock price following the earnings announcement.

### Financial Performance Insights Despite the recent downturn, UnitedHealth Group remains financially robust. The company's valuation metrics show a normalized price-to-earnings ratio of 16.74, with a quick ratio of 0.74, indicating a healthy liquidity position. The return on equity (ROE) stands at a solid 25.16%, reflecting efficient use of shareholders' investments.

### Market Dynamics and Future Outlook The broader market dynamics also play a crucial role in UnitedHealth's stock performance. The healthcare sector is currently navigating a complex landscape of regulatory changes, technological advancements, and evolving consumer behaviors. UnitedHealth Group, with its diverse offerings including dental, hospital, and clinical services, is well-positioned to adapt to these changes. However, the recent volatility underscores the need for cautious optimism as the company continues to navigate these challenges.

### Conclusion The recent volatility in UnitedHealth Group's stock highlights the intricate nature of the healthcare sector. While the company's financial health remains robust, the soft revenue guidance and broader market trends pose challenges. Investors will need to closely monitor the company's performance and adapt their strategies accordingly. Despite the turbulence, UnitedHealth Group's strong fundamentals and adaptive capabilities offer a glimmer of hope for future growth, making it a stock to watch closely in the coming months.