UnitedHealth Group Inc. (UNH) has been a prominent name in the healthcare sector, and its stock performance has been a focal point for investors. With the recent stock meltdown and a turnaround effort in progress, understanding the current landscape and future prospects of UNH stock becomes crucial for both existing and potential investors.

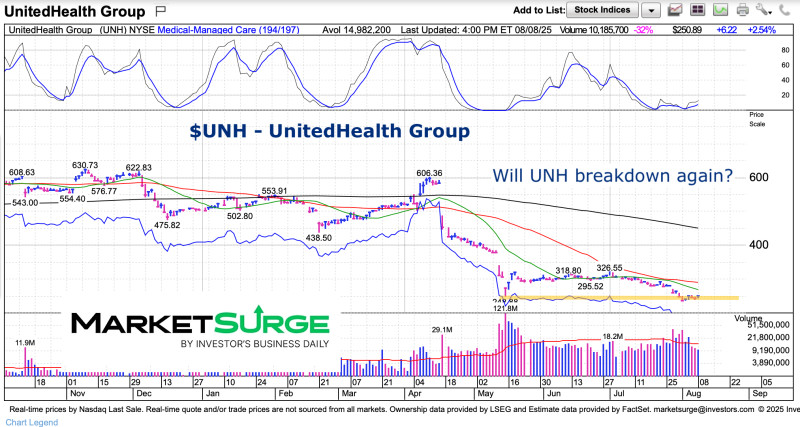

The stock price of UnitedHealth Group Inc. has seen significant volatility, particularly after a 20% plunge last year. This downturn prompted the company to initiate a turnaround effort, which is critical for regaining investor confidence. The stock's performance is closely monitored by various financial platforms, including MarketWatch, CNBC, and Google Finance, which provide real-time stock prices, quotes, and comprehensive financial overviews to help investors make informed decisions.

Investors rely on detailed financial information and analysis to gauge the company’s health and future prospects. Platforms like Investopedia, Morningstar, and MarketBeat offer in-depth analysis, price targets, and dividend information, which are essential for making well-informed investment decisions. For instance, Morningstar provides the latest stock price, related news, and valuation metrics, which are crucial for evaluating the company's potential.

In addition to the stock price, investors also focus on UNH earnings to assess the company's financial health. Earnings reports provide insights into the company's revenue, net income, and earnings per share, which are vital indicators of its performance. UnitedHealth Group's financial performance is closely scrutinized by analysts and investors alike, with platforms like Investing.com offering real-time notifications and analysis to keep investors updated on any changes in the stock price.

Overall, while UnitedHealth Group Inc. faces challenges, its turnaround efforts and the availability of comprehensive financial data provide opportunities for investors to make strategic decisions. Monitoring the stock's performance, earnings reports, and market analysis will be key for navigating the current landscape and capitalizing on potential future growth.