In 2026, a new financial tool is set to revolutionize the way parents and guardians prepare for their children's future Trump Accounts. These accounts, often referred to as "Trump accounts for kids," offer a unique way for the next generation to jump-start their savings and investments, providing them with a significant head start in financial planning. This article delves into the specifics of Trump Accounts, their benefits, and how to claim the associated government contributions.

Trump Accounts are a new kind of individual retirement account (IRA) specifically designed for children 18 and younger. Notably, the eligibility criteria and benefits of Trump Accounts extend to newborns who might receive a $1,000 government deposit. This initiative is part of a broader strategy to enhance financial literacy and savings habits among young Americans. The accounts are structured as a traditional IRA, with contributions made by parents, guardians, and authorized individuals. These contributions are subject to various tax rules and IRS guidelines, making it crucial for families to understand the specifics to maximize their benefits.

To open a Trump Account, parents or guardians will need to fill out IRS Form 4547, which is the official form to establish the account and claim the $1,000 federal pilot contribution. It is recommended to include this form with your 2025 tax return, due on April 15, 2026. This process ensures that families can start taking advantage of the account's benefits as early as possible. However, it's important to note that while contributions can't begin until mid-2026, families can begin preparing now to make the most of this opportunity.

In addition to the $1,000 government seed contribution, some 25 million American children are expected to benefit from this program. The eligibility criteria and the specifics of how these contributions are managed are still being clarified by the IRS, but it is clear that the program aims to provide a significant boost to children's financial futures. These accounts offer a wealth-building opportunity that could significantly impact a child's financial security in the long run. The combination of tax advantages and government contributions makes Trump Accounts an attractive option for long-term savings.

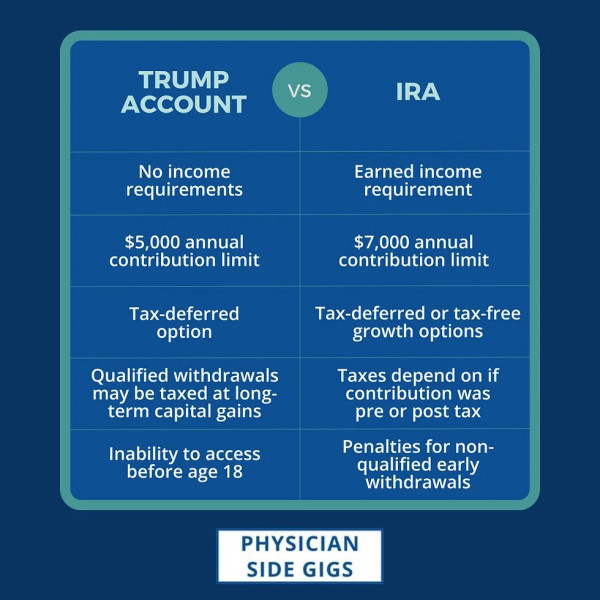

While Trump Accounts offer a unique advantage, they are not the only savings option available. Families should also consider other tools like 529 plans and Roth IRAs, each with its own set of benefits and limitations. The key is to understand how Trump Accounts compare to these other options and to tailor the savings strategy to the specific needs and goals of the family.

In summary, Trump Accounts present a valuable opportunity for families to start their children on a path to financial stability. With tax advantages and potential government contributions, these accounts offer a unique way to jump-start savings for the next generation. By understanding the rules, contribution limits, and tax implications, families can make informed decisions that will benefit their children for years to come. As the program unfolds, staying informed about the latest updates and guidelines will be crucial for maximizing the benefits of Trump Accounts.