The process of filing taxes can be daunting, but one of the most anticipated aspects is receiving your refund. The Internal Revenue Service (IRS) offers several tools and resources to help you track the status of your tax refund efficiently. This article will guide you through the process of using "Where's My Refund?" and other tools to check your refund status and understand the timeline for receiving your money.

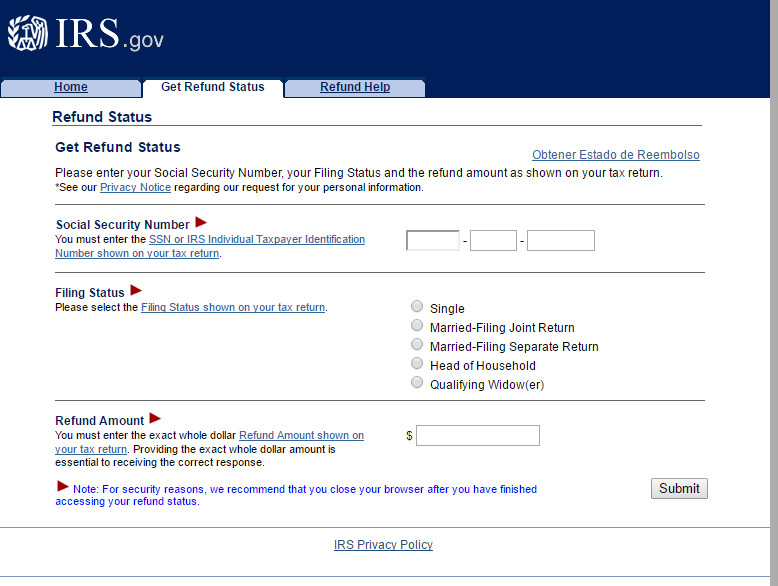

One of the primary tools provided by the IRS is "Where's My Refund?". This user-friendly online tool allows taxpayers to check the status of their federal tax refund. To use this service, you will need to provide your Social Security Number, the tax year you are inquiring about, your filing status, and the exact refund amount shown on your tax return. All required fields must be accurately filled to retrieve your refund information .

In addition to the online tool, the IRS offers a mobile app called IRS2Go. This app provides a convenient way to check your refund status on the go. You can download it from your app store and use it to track your refund status in real-time. For those who prefer traditional methods, the IRS also provides a phone line at 800-829-1954 for current-year refunds and 866-464-2050 for amended returns, offering an automated system to check your refund status .

For those who prefer a more comprehensive look into their tax records, the IRS allows you to access your tax information through your online account. You can request a copy (transcript) of your tax records, which can be useful for various purposes, including tracking your refund status. This service is particularly helpful if you need to verify your tax information or if you suspect any discrepancies in your refund process .

It's important to note that the IRS issues most refunds within 21 days after e-filing your return. However, if you file a paper return, it may take up to 4 weeks. If you haven't received your refund within these timeframes, it's advisable to use the "Where's My Refund?" tool to check for any updates or potential delays .

When tracking your refund status, it's crucial to understand the possible reasons for delays. Common reasons include errors in your tax return, identity verification issues, or additional review processes. The IRS provides detailed information on these delays and offers guidance on how to resolve them, ensuring that you receive your refund as smoothly as possible .

In addition to federal refunds, many states offer their own tools to track state refund statuses. For instance, if you need to track your state refund, you can select the link for your specific state on the IRS website or use resources provided by your state's tax department. This ensures that you have a comprehensive view of all your refunds, both federal and state .

Tracking your tax refund status doesn't have to be a complicated process. With the right tools and resources, you can stay informed and ensure that you receive your refund in a timely manner. Whether you prefer using the "Where's My Refund?" tool, the IRS2Go app, or checking your tax information online, the IRS provides multiple avenues to help you stay on top of your refund status. Make use of these resources to streamline your tax refund experience and get your money when you need it most.