The retail sector is currently under intense scrutiny, and all eyes are on Target Corporation (TGT) as it prepares to unveil its third-quarter earnings today, 19th November 2025, before market open. As the U.S. economy continues to grapple with post-pandemic recovery, TGT stock has seen a roller coaster ride, with a decline of 34.5% year-to-date. Investors and analysts alike are closely monitoring the upcoming report to gauge the retailer's performance and future outlook.

The upcoming earnings report is expected to shed light on several key areas, including the company’s financial health, consumer spending trends, and strategic initiatives to drive growth. Michael Fiddelke, the incoming CEO of Target, highlighted the challenges and opportunities ahead, stating that while the third-quarter performance was in line with expectations, multiple challenges persist. The company's earnings conference call, scheduled for 7:00 AM CT, will provide deeper insights and address investor concerns.

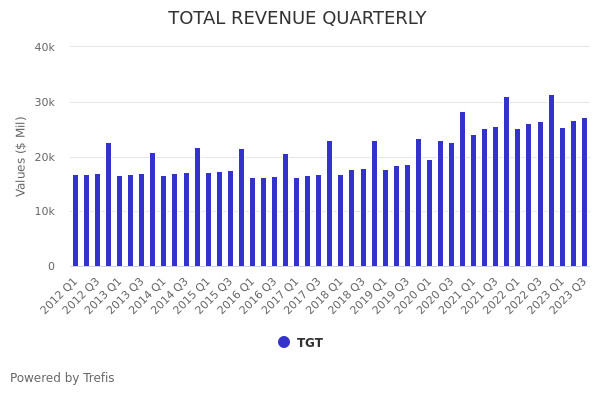

Target has been proactive in adjusting its full-year guidance, anticipating a low single-digit decline in comparable sales and projecting GAAP EPS in the range of $8 to $10. Despite the challenges, the company has managed to deliver a positive revenue surprise of 0.36% for the quarter ended October 2025, although the adjusted EPS of $1.78 marks a 4% decrease from last year.

Analysts predict that the company will report a 1.3% decline in revenue for the third quarter, coupled with adjusted earnings of $1.72 per share. This outlook aligns with broader consumer trends, which have shown a shift in spending patterns and increased price sensitivity. Target's strategy to navigate these trends includes aggressive price cuts and promotions, aimed at boosting customer loyalty and market share.

As of the latest data, Target’s earnings per share (EPS) for the trailing twelve months (TTM) stands at $8.58. This figure underscores the company's resilience in the face of economic challenges, although it remains to be seen how the upcoming earnings report will influence this metric. Investors are closely monitoring the performance metrics, with many optimistic that the stock could see a rebound if the earnings meet or exceed expectations.

The upcoming earnings report from Target Corporation (TGT) is a critical juncture for the retail giant. Despite the headwinds in the retail sector, Target's strategic initiatives and leadership transitions offer a glimmer of hope. Investors and market analysts will be scrutinizing the report to gauge the company's ability to navigate the challenges and capitalize on emerging opportunities. The earnings call, slated for 7:00 AM CT, will provide invaluable insights into the company's future trajectory and its plans to steer through the turbulent retail landscape.