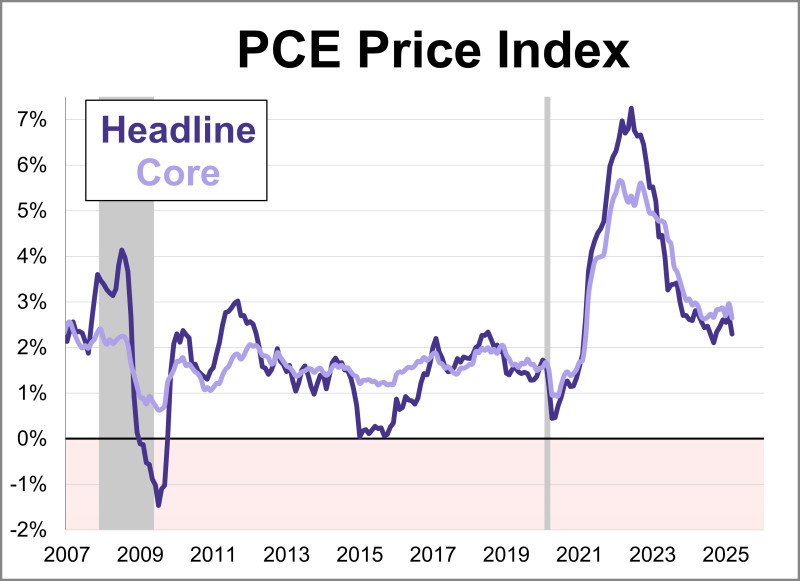

The latest PCE inflation data, released May 30, shows that the Personal Consumption Expenditures (PCE) price index rose.1% year-over-year in April 2025, marking the lowest inflation rate since September 2021. This is a slowdown from the.3% increase recorded in March and falls just below market expectations The core PCE price index, which excludes food and energy and is closely watched by the Federal Reserve, climbed.5% over the past year—its lowest level in more than four years and also down from.7% in March.

On a monthly basis, both the headline and core PCE indices advanced just 0.1%, in line with forecasts The PCE index is the Fed’s preferred inflation gauge, tracking changes in prices paid by U.S. consumers for goods and services, and is a key factor in monetary policy decisions.

With inflation cooling but still above the Fed’s 2% long-term target, investors and policymakers are closely watching the upcoming PCE report scheduled for June 27, which could influence the timing of any future interest rate adjustments.