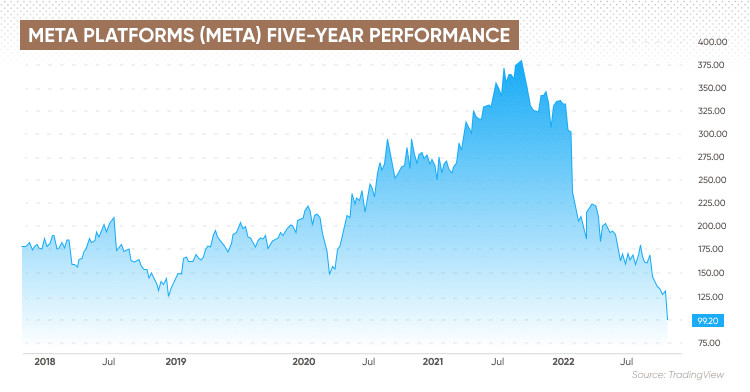

In recent news, Meta Platforms Inc. (META) has seen a significant positive momentum, with a 3.6% stock increase following the announcement of substantial budget cuts to its metaverse division. This move comes as the company aims to streamline its operations and focus on more profitable ventures, a critical strategy in the current economic climate.

Meta's stock has been a subject of considerable interest, with its market cap currently standing at 1.67 trillion dollars, and a price of 662.76 dollars per share. While the company's price-to-earnings ratio stands at 28.26, it's also worth noting that it currently pays dividends of 32.4%. This financial overview positions Meta as a formidable player in the tech industry, but the company's future trajectory remains heavily influenced by its strategic decisions, particularly in the metaverse sector.

The metaverse, a virtual world that Meta has been heavily investing in, has seen significant budget cuts. This decision comes amidst a broader strategy to maximize profits and efficiency. While the metaverse holds tremendous potential, the current economic conditions and the need for immediate returns have led Meta to reassess its investment priorities. The metaverse remains a focal point for many tech companies, and its future success could significantly impact Meta's stock performance.

Meta's third-quarter revenues were reported at 51.24 billion dollars, marking a 26.2% year-over-year increase, which exceeded market forecasts by 3.4%. This financial performance indicates a strong underlying business model, capable of generating substantial revenue even in the face of significant challenges. The company also surpassed earnings and EBITDA estimates, suggesting a robust operational framework.

Despite these positive indicators, the stock market remains volatile, and Meta is not exempt from these fluctuations. The price of META shares has risen by 27.10 dollars, marking a 4.24% increase, with the stock opening at 675.88 dollars, 36.28 dollars higher than its previous day's closing price. This volatility underscores the importance of staying informed about the company's strategic decisions and market trends.

Analysts have provided a range of forecasts for Meta's stock, with an average rating of "Strong Buy" from 45 analysts. The 12-month stock price target is 820.91 dollars, representing a 23.97% increase from the current price. These forecasts suggest a bullish outlook, but it's essential to consider the broader economic context and the potential impact of Meta's strategic decisions on its stock performance.

In conclusion, Meta's stock remains a compelling investment opportunity, given its strong financial performance and strategic focus on the metaverse. However, investors should closely monitor the company's decisions and market trends to make informed decisions. The metaverse remains a critical area of focus, and its future success will significantly influence Meta's stock performance.