Meta Platforms, Inc. (META), the tech conglomerate behind popular platforms like Facebook, Instagram, and WhatsApp, has been in the spotlight recently due to its significant stock movements. As of the latest reports, META stock has seen a 3.6% increase, driven by strategic budget cuts in its metaverse division, a sector that has been under intense scrutiny for its high costs and uncertain returns. This move signals a shift in Meta's focus towards more profitable ventures, aiming to bolster its financial health and investor confidence.

Meta Platforms, Inc. has been navigating a complex market landscape. The company's stock has demonstrated resilience, with a current market cap of 1.67T and a price of $662.76. The stock's price-to-earnings ratio stands at 28.26, and it offers dividends at a yield of 32.4%. These figures highlight the mixed sentiment surrounding META, as investors weigh the potential for growth against the company's current fiscal challenges.

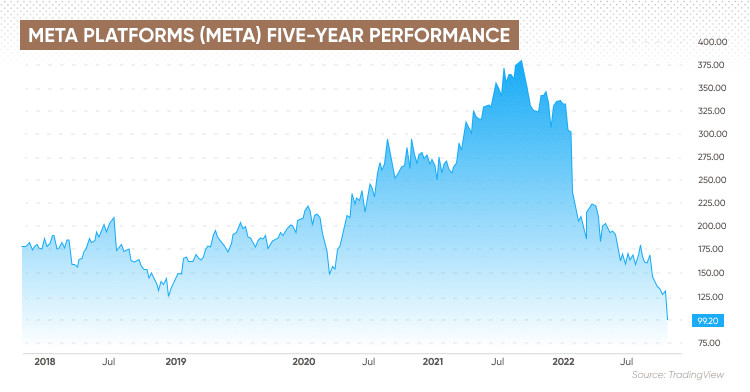

The stock's performance has been marked by volatility, with a 52-week high of $796.25 and a low of $479.80. The recent price increase of $27.10, representing a 4.24% rise, indicates a positive trend, although it opened at $675.88, which is $36.28 higher than its previous closing price. This volatility underscores the speculative nature of the stock, influenced by both market sentiment and company-specific developments.

The company's recent financial performance has been noteworthy. Meta Platforms reported Q3 revenues of $51.24 billion, marking a 26.2% year-over-year increase and surpassing forecasts by 3.4%. Additionally, the company exceeded EBITDA estimates, demonstrating strong operational efficiency. These financial metrics suggest that Meta is on a path to recovery, despite the ongoing challenges in the metaverse sector.

Analysts remain generally optimistic about META's future, with 45 analysts giving the stock an average rating of "Strong Buy." The 12-month stock price target is $820.91, reflecting an anticipated 23.97% increase from current levels. This bullish outlook is further supported by recent upgrades and positive analyst reports, which highlight Meta's potential for growth and innovation. For instance, Arete upgraded the stock from Neutral to Buy with a target price of $718, while BNP Paribas Exane initiated coverage with an Outperform rating and a target price of $800.

Looking ahead, Meta Platforms is poised to continue its strategic realignment, focusing on core strengths while managing the metaverse's high costs. The company's ability to adapt and innovate will be crucial in determining its future market performance. As investors and analysts closely monitor these developments, META's stock remains a compelling, albeit volatile, investment option in the tech sector.