The landscape of student loan repayment is undergoing significant changes, with the U.S. Education Department set to resume wage garnishment for borrowers in default starting in early 2026. This move, part of the broader strategy to recoup federal student loan debts, has sparked a wave of concern and action among borrowers and advocacy groups. Understanding the implications and potential strategies to mitigate these challenges is crucial for the millions of Americans affected.

Wage garnishment, a process where a portion of a borrower's paycheck is withheld to repay defaulted loans, is a powerful tool for the federal government to recover outstanding debts. Borrowers in default, defined as those missing payments for at least 270 days, are at risk of having their wages garnished. This process requires at least 30 days' notice before implementation, allowing borrowers some time to explore alternatives.

For borrowers, the impact of wage garnishment can be severe, affecting their financial stability and ability to meet everyday expenses. The Trump administration's decision to resume this practice in January 2026 comes after a period of relative calm, during which garnishment orders were paused. The resumption of wage garnishment is expected to affect about 1,000 borrowers initially, with the potential for a broader impact as the program expands.

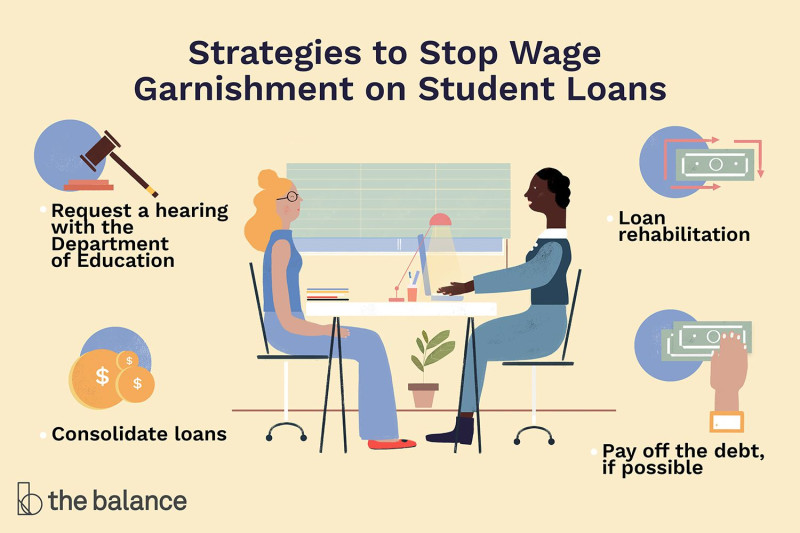

The rules governing student loan wage garnishment are specific and differ between federal and private loans. For federal student loans, wage garnishment can only occur after a borrower is in default, whereas private loans may have different thresholds and enforcement mechanisms. Borrowers facing wage garnishment have several options to reduce or stop it, including loan rehabilitation, consolidation, or enrolling in an income-driven repayment plan.

Understanding these options and taking proactive steps can significantly mitigate the financial strain of wage garnishment. Loan rehabilitation, for instance, allows borrowers to make a series of affordable payments over a specified period to bring their loans out of default. This process not only stops the garnishment but also restores the borrower's eligibility for various federal aid programs and benefits.

Loan consolidation, another viable option, involves combining multiple federal student loans into a single loan with a new repayment plan. This can simplify the repayment process and may offer more manageable terms, making it easier for borrowers to stay current on their payments and avoid default.

Income-driven repayment plans, such as the Income-Based Repayment (IBR) or Pay As You Earn (PAYE) plans, adjust the monthly payment amount based on the borrower's income and family size. These plans can provide a safety net, ensuring that payments remain affordable even in times of financial hardship.

For borrowers already facing wage garnishment, it is crucial to take immediate action. The earlier a borrower addresses the issue, the higher the likelihood of successfully reducing or stopping the garnishment. Borrowers should contact their loan servicers to explore the available options and develop a plan tailored to their financial situation. Federal Student Aid resources and legal support from organizations like Nolo can provide valuable guidance and advocacy during this challenging time.

The resumption of wage garnishment for student loan borrowers in 2026 represents a significant shift in the federal government's approach to debt collection. While the move aims to ensure accountability and recovery of outstanding debts, it also underscores the need for proactive financial management and awareness among borrowers. By understanding the rules, exploring available options, and seeking timely assistance, borrowers can navigate these challenges and work towards financial stability.