As of 2026-01-03, the oil prices have seen a notable decline, with significant implications for global energy markets. Crude oil prices have dropped to $57.32 per barrel, marking a 0.17% decrease from the previous day's close. This trend is part of a broader monthly decline of 2.77% and an annual decrease of 22.50%. The current oil futures prices reflect this downward trajectory, with WTI futures trading at $57.32.

The oil price dynamics are influenced by various factors, including supply and demand, geopolitical tensions, and economic indicators. The current price trends suggest a bearish market sentiment, which could be attributed to rising global oil inventories and expectations of increased supply. The U.S. Energy Information Administration (EIA) forecasts that global oil inventories will continue to rise through 2026, exerting downward pressure on oil prices in the coming months. This outlook aligns with the recent performance of crude oil, which has been characterized by a steady decline.

For investors and traders, understanding the oil futures market is crucial. The WTI crude oil futures for February 2026 are currently trading at $57.74 per barrel. This price point is significant for market participants as it provides insights into future price movements and helps in making informed trading decisions. The daily trading range for WTI futures is also a key metric, indicating the volatility and potential price swings in the oil market.

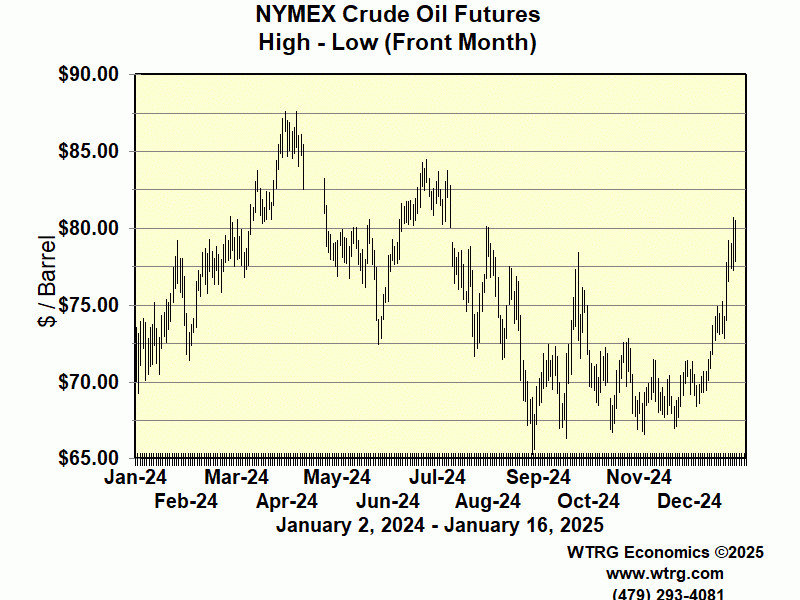

The oil price chart for WTI shows a consistent downward trend, with prices falling from $57.42 to $57.32 in the latest trading session. This decline is part of a broader pattern observed over the past month, where prices have fallen by 2.77%. The historical data for crude oil prices provides valuable context for understanding current market conditions and anticipating future price movements.

The oil market is influenced by a myriad of factors, including geopolitical events, economic policies, and technological advancements. The recent crack spread, which measures the difference between the purchase price of crude oil and the selling price of finished products, indicates a narrowing margin for refiners. This trend could impact the profitability of refining operations and influence future oil prices.

In conclusion, the current oil prices and oil futures reflect a market in transition. The downward trend in prices, driven by rising inventories and bearish market sentiment, presents both challenges and opportunities for market participants. As the year progresses, it will be essential to monitor key indicators and economic data to navigate the complexities of the oil market effectively.