The landscape of mortgage rates has been dynamic and ever-evolving, making it essential for potential homebuyers and existing homeowners to stay informed. As of 2026, mortgage rates have been influenced by various economic factors, including inflation, Federal Reserve policies, and housing market trends. This article delves into the current state of mortgage rates, providing insights into what homebuyers can expect and how to navigate the market effectively.

Current mortgage rates are a critical factor for anyone looking to purchase a home or refinance an existing loan. Understanding these rates can help homebuyers make informed decisions. As of 2026, mortgage rates have seen fluctuations, influenced by economic indicators and Federal Reserve policies. According to Bankrate, comparing personalized mortgage and refinance rates from a national marketplace of lenders is crucial for finding the best current rate suited to one's financial situation.

To get a clearer picture, it's important to explore today's mortgage rates and trends. Forbes Advisor provides a comprehensive overview, helping potential borrowers compare current rates and Annual Percentage Rates (APRs) to find the best loan options available. This resource is invaluable for those aiming to secure a mortgage that aligns with their financial goals.

Fixed and adjustable-rate loans are two primary types of mortgages that homebuyers need to consider. Bank of America offers a detailed look at today's mortgage rates for both types. By providing a custom rate based on factors such as purchase price, down payment amount, and ZIP code, Bank of America helps borrowers explore their home loan options more effectively.

For those seeking the most accurate data, Daily Index offers a national average index calculated daily. This resource is particularly useful for individuals purchasing or refinancing a home, as it provides up-to-date information on current mortgage rates. This daily update ensures that borrowers have access to the most relevant data when making financial decisions.

Additionally, comparing mortgage interest rates can save homebuyers significant amounts of money over the life of their loan. NerdWallet provides today's average mortgage interest rates and APRs, allowing borrowers to compare customized rates and make informed choices. This comparison tool is essential for securing a mortgage that fits within one's budget.

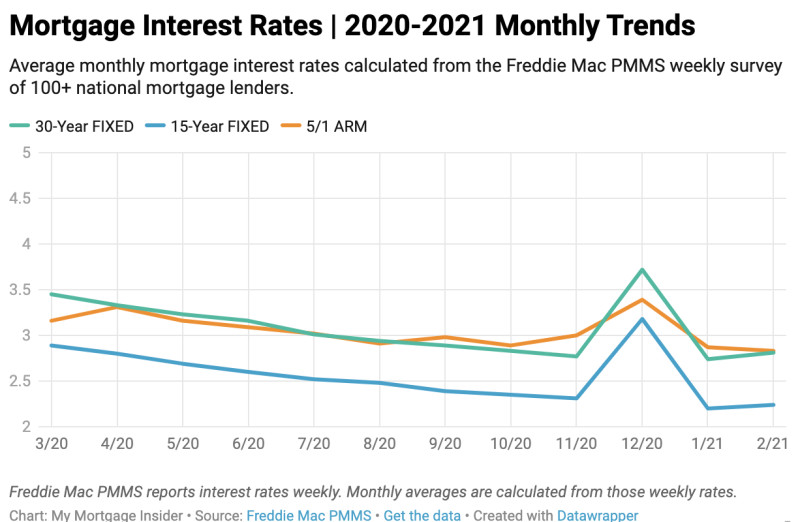

Historical trends and real-time data also play a crucial role in understanding mortgage rates. My Rate Plan offers the latest mortgage rates for 30-year and 15-year fixed loans, along with tools to calculate payments and track historical trends. This source, updated daily with data from Freddie Mac and the Federal Reserve, helps borrowers stay informed about market fluctuations and make timely decisions.

Zillow Home Loans provides a user-friendly platform for exploring current mortgage rates by loan type. Whether you're looking for a fixed-rate or adjustable-rate mortgage, Zillow allows users to get a personalized rate estimate quickly, making the homebuying process more efficient.

For a broader perspective, realtor.com® offers current mortgage rates from multiple lenders. By comparing the latest rates, loans, payments, and fees for both ARM and fixed-rate mortgages, homebuyers can make well-informed decisions tailored to their specific needs. This platform helps borrowers navigate the complex landscape of mortgage rates with ease.

Furthermore, LendingTree provides a detailed comparison of mortgage interest rates, helping borrowers find the best rates for their home loans. By reviewing daily average mortgage rate trends and forecasts for 2025, homebuyers can anticipate potential changes in the market and plan accordingly.

In conclusion, staying informed about current mortgage rates is crucial for making sound financial decisions. With a variety of resources available, potential homebuyers and current homeowners can compare rates, explore loan options, and secure the best deals. As the market continues to evolve, keeping up with the latest trends and using available tools can significantly enhance one's homebuying experience.