As technology continues to advance at an unprecedented pace, the demand for semiconductors is skyrocketing, making TSM stock a focal point for investors and analysts alike. Taiwan Semiconductor Manufacturing Company (TSM), often referred to as TSM, is the world's leading semiconductor manufacturer, known for its cutting-edge technology and strategic position in the global market. Here, we provide an in-depth look at the latest trends, performance, and future outlook for TSM stock .

The semiconductor industry is highly competitive, but TSM has carved out a niche for itself as a pioneer in advanced semiconductor manufacturing processes. The company's state-of-the-art facilities and innovative technologies have enabled it to produce some of the most advanced chips in the world. This competitive edge is reflected in TSM's robust financial performance and its ability to attract significant investment interest .

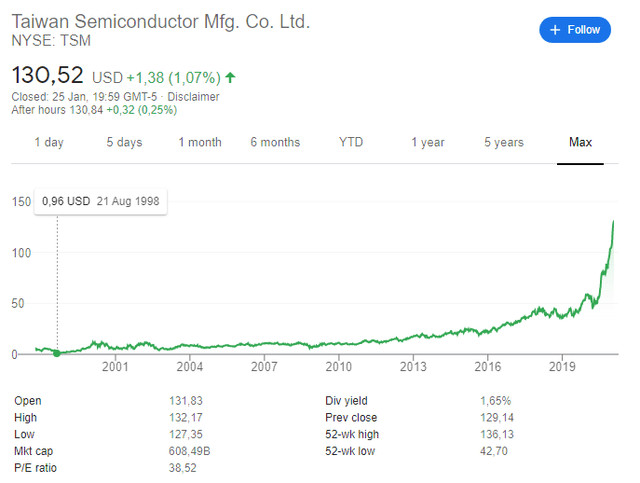

In recent months, TSM stock has shown remarkable resilience and growth despite market volatility. This can be attributed to several factors, including increased demand for semiconductors driven by the rise of artificial intelligence (AI), 5G technology, and the Internet of Things (IoT). TSM's strategic investments in these high-growth areas have positioned the company as a key player in the future of technology .

Analysts have also highlighted TSM's strong financial metrics, including its earnings per share (EPS) and return on equity (ROE), as key indicators of the company's financial health. These metrics suggest that TSM is well-positioned to continue delivering value to its shareholders in the long term. Moreover, the company's dividend policy and share buyback programs further underscore its commitment to rewarding investors .

TSM's commitment to innovation is another critical factor driving its success. The company's R&D investments have led to significant breakthroughs in semiconductor technology, enabling it to stay ahead of the competition. This focus on innovation is not just about staying relevant in a rapidly evolving industry; it's also about creating new opportunities for growth and expansion .

The future outlook for TSM stock remains bullish, with many analysts predicting continued growth. This optimistic outlook is buoyed by the increasing demand for semiconductors, coupled with TSM's strong market position and innovative capabilities. However, investors should remain vigilant and stay informed about potential risks and challenges, such as geopolitical tensions and supply chain disruptions, which could impact the semiconductor industry as a whole .