AMD (Advanced Micro Devices, Inc.) has announced its fiscal fourth quarter and full-year 2025 financial results as of today, February 3, 2026, after the market closes . The earnings report is a critical event for investors, especially given the company's recent performance and market expectations. AMD's stock has shown a remarkable 115% increase over the past year, driven by factors such as the surge in demand for AI GPUs and strategic partnerships, notably with OpenAI .

The earnings report is anticipated to reveal a record revenue of $10.3 billion for the fourth quarter, up from the 2024 level, a gross margin of 54%, operating income of $1.8 billion, a net income of $1.5 billion, and diluted earnings per share of $0.92. These figures place the company in a strong position within the tech industry, with a non-GAAP gross margin of 57%.

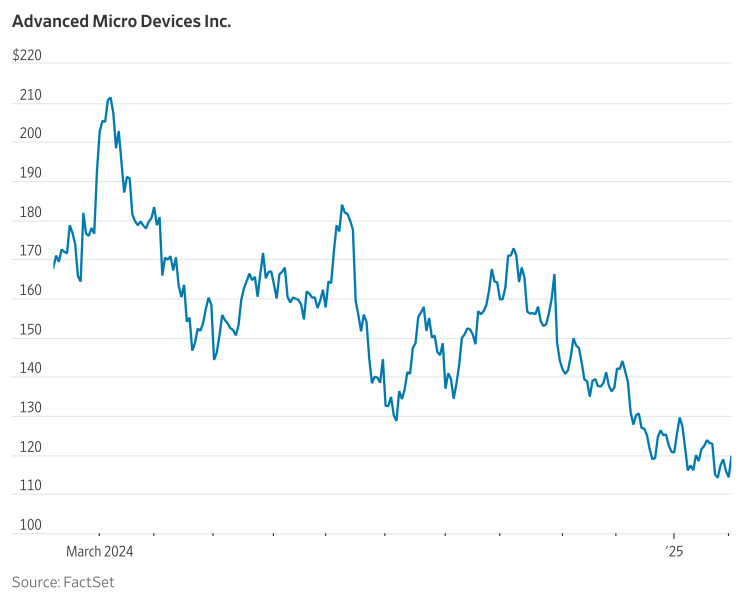

However, the stock market's overall performance today has been less than favorable, influencing AMD's stock price. The market downturn can be attributed to broader economic uncertainties and investor concerns about future earnings, particularly in light of recent AI spending concerns and analysts' expectations for Q4 EPS and revenue .

The broader tech sector, including AMD, has been affected by investor sentiment shifting towards risk aversion. Many analysts predict that AMD will continue to perform well in the long term, but short-term volatility often leads to fluctuations in stock prices. This situation underscores the importance of understanding both the company's immediate financial health and the broader economic climate.

AMD's earnings beat analysts' revenue expectations by 5.6% last quarter, reporting revenues of $9.25 billion, up 35.6% year on year . This impressive performance suggests that AMD is well-positioned to continue outperforming, especially with its growing AI GPU business and steady CPU demand. However, the current stock market downturn reflects the broader market's cautious outlook, influenced by various economic factors and investor sentiment.