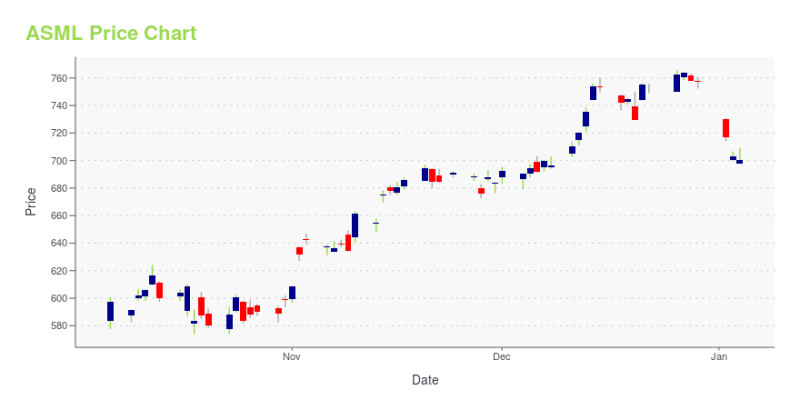

ASML Holding (ASML), the Dutch semiconductor equipment giant, has seen its stock price swing sharply in April. After a.6% drop in premarket trading last week, the stock is now hovering around €57, marking a 4% decline in the past hours and extending a month-long slide of nearly 11%6. Over the past year, ASML shares have plummeted by more than 36%, despite the company’s dominant position in the chipmaking industry and strong quarterly earnings.

Yet, analysts remain optimistic. Forecasts for suggest ASML’s average stock price could reach $1,43, with some estimates as high as $1,680—potentially doubling from current levels. The company recently reported quarterly earnings of €6.0 per share, beating expectations, and posted revenues of €7.7 billion. Its order book remains robust, with €3.9 billion in new orders in Q.

Market volatility and macroeconomic concerns have weighed on the stock, but many see the dip as a buying opportunity. ASML’s unique role in supplying advanced lithography systems for semiconductor manufacturing keeps long-term growth prospects intact, especially as demand for AI and advanced chips accelerates. Investors are watching closely: will ASML’s stock rebound as forecasts predict, or is more turbulence ahead?