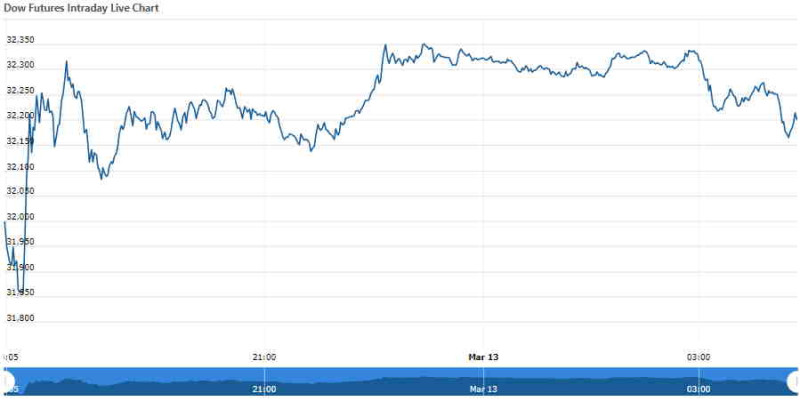

The Dow Jones Industrial Average futures are currently in a nosedive, signaling another tumultuous day for investors. As of this morning, the market futures have taken a sharp turn south, with traders and analysts alike scratching their heads over what could be causing such a dramatic shift.

It's not just the Dow that’s feeling the pinch; the broader S&P 500 and Nasdaq futures are also showing signs of weakness. The tech-heavy Nasdaq is particularly vulnerable, as it has been for much of this year. But today feels different—like a collective sigh from Wall Street.

So what's behind this sudden downturn? Analysts point to a mix of factors, including geopolitical tensions and economic data that’s not quite hitting the mark. The latest jobs report came in weaker than expected, which is never good news for market sentiment. And let's not forget about those pesky interest rates—still climbing despite all the Fed's best efforts.

But it's not just macroeconomic factors at play. Individual company earnings reports have been lackluster, with several tech giants missing their targets. This has investors questioning whether the current bull run can sustain itself much longer.

The Dow futures are currently down by over 300 points, a stark contrast to yesterday’s modest gains. It's a reminder that in today's market, stability is fleeting and volatility reigns supreme. Traders are bracing for another rollercoaster ride as they navigate the choppy waters of global finance.

Meanwhile, AT&T customers might be feeling their own form of turbulence. Reports of network connectivity issues have been flooding community forums, adding to the general sense of unease. It's not just about dropped calls and spotty internet—it’s a broader issue that affects trust in service providers during already uncertain times.

As for what this means for the rest of the day, it's anyone's guess. But one thing is certain: investors will be glued to their screens, hoping for some semblance of clarity amidst the chaos. The Dow futures now are a clear indicator that today might not end on a high note.

So here we are, at the mercy of market forces and corporate missteps, wondering if this is just another blip in an otherwise steady climb or the beginning of something more ominous. Only time will tell, but for now, it's all about hanging on tight and hoping for better days ahead.