Advanced Micro Devices (AMD) delivered a first-quarter earnings report that beat Wall Street expectations, but the stock’s reaction has left investors guessing about what’s next for the chipmaker.

AMD posted Q1 revenue of $7.44 billion and adjusted earnings per share of $0.9, both topping analyst estimates The company’s data center segment was a standout, with revenue jumping 57% year-over-year, fueled by strong demand for AI and server chips Meanwhile, PC chip sales soared 68%, reflecting robust interest in AMD’s Ryzen processors

Looking ahead, AMD forecasts second-quarter revenue of about $7. billion-again above consensus-but warned of an $800 million hit due to new U.S. export restrictions on AI chips to China These curbs could cost AMD up to $1. billion in revenue for the year

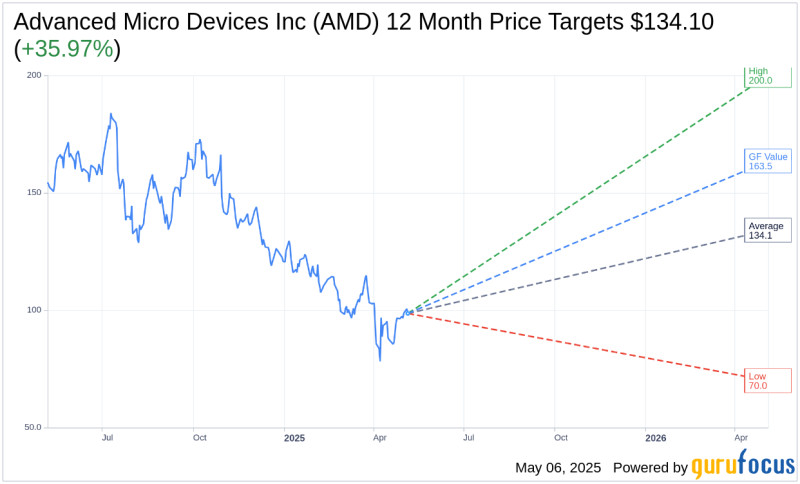

Despite the upbeat results and guidance, AMD shares initially climbed over 5% in after-hours trading before reversing course and dipping below the previous close The volatility highlights investor uncertainty about the long-term impact of trade restrictions, even as AMD’s CEO Lisa Su remains confident in the company’s AI leadership and growth prospects