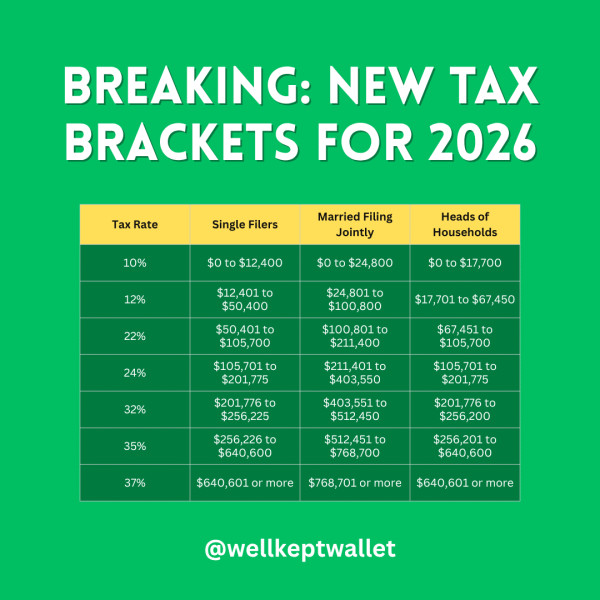

The Internal Revenue Service (IRS) has announced significant updates for the **2026 tax brackets**, reflecting the annual inflation adjustments for over 60 tax provisions. These changes, outlined in Revenue Procedure 2025-32, will impact how taxpayers are taxed in the coming year . This comprehensive guide will walk you through the key changes and what they mean for your financial planning.

One of the most notable adjustments is the increase in the income thresholds for the two lowest tax brackets, which rise by approximately 4%. This means that more of your income will fall into these lower brackets, potentially reducing your overall tax liability. In contrast, the higher tax brackets see a more modest increase of around 2.3% . This disparity highlights the IRS's approach to adjusting tax brackets based on inflation, ensuring that the tax system remains fair and equitable for all income levels .

In 2026, the federal income tax system will retain its seven-tier structure, with rates ranging from 10% to 37%. The income limits for each bracket have been adjusted for inflation, which means that taxpayers will need to refer to the updated tables to determine their tax liability accurately. For instance, the 10% bracket will apply to a wider range of incomes, providing some relief to lower- and middle-income earners .

Additionally, the **2026 tax brackets** adjustments are part of a broader set of changes, including new and increased deductions created by the 2025 One Big Beautiful Bill Act. This legislation aims to simplify the tax code and provide additional benefits to taxpayers, such as higher standard deductions and enhanced credits for families and businesses .

For those looking to maximize their tax savings, understanding the **new tax brackets** for 2026 is crucial. By staying informed about the changes, taxpayers can better plan their financial strategies, take advantage of available deductions, and optimize their tax liability. Whether you are a single filer, married filing jointly, or head of household, the updated tax brackets will affect your taxable income and overall financial situation in 2026 .

In summary, the **2026 tax brackets** represent a significant update to the federal income tax system, reflecting the IRS's commitment to adjusting for inflation and ensuring fairness. By understanding these changes, taxpayers can better navigate the complex landscape of tax planning and optimize their financial strategies for the coming year. As always, consulting with a tax professional can provide personalized advice and ensure that you are taking full advantage of the new tax brackets and deductions .