As Tax Day approaches, millions of Americans are scrambling to file their returns—but what if you need more time? The IRS offers a straightforward solution: file for a tax extension by April and you’ll have until October, 202, to submit your federal return.

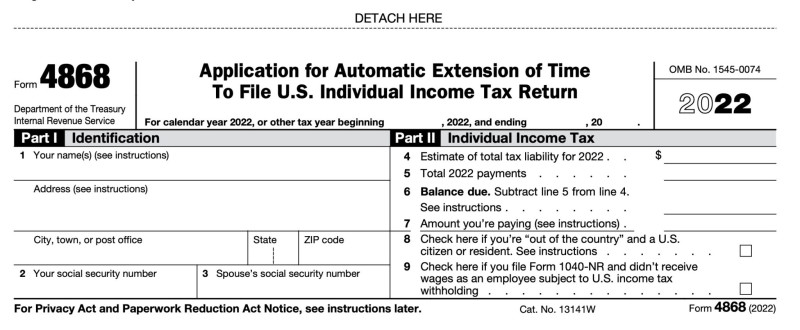

Requesting an IRS income tax extension is easier than ever. Taxpayers can use IRS Free File online, pay electronically and select “extension,” or mail Form to the IRS. No matter which method you choose, the extension only gives you more time to file, not to pay. Taxes owed are still due by April to avoid penalties and interest.

Special circumstances apply for some. If you live in a state affected by recent natural disasters, the IRS may have already extended your deadline automatically—some residents have until May, October, or even November to file, depending on their location. U.S. citizens abroad and military personnel in combat zones also get extra time.

Remember, filing late without an extension can result in penalties of up to 5% per month, capped at 25% of the unpaid tax. Not paying on time adds a separate penalty of.5% per month.

Don’t let the deadline sneak up on you. If you’re not ready, act before midnight on April to secure your extension and avoid costly mistakes.