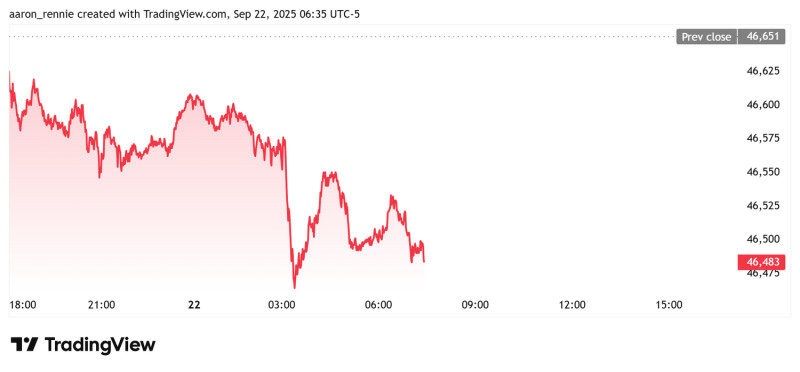

The Dow Jones Industrial Average (DJIA), often simply called the Dow, is one of the most widely recognized stock market indices in the world. A key metric for investors and analysts alike, the DJIA represents the performance of 30 large, blue-chip companies in the U.S. stock market. Today, December 29, 2025, the DJIA stands as a pivotal indicator of market health and economic trends, reflecting the broader movements of the U.S. economy.

The Dow Jones Industrial Average, established in the late 19th century, is one of the oldest and most respected market benchmarks. Initially composed of just 12 companies, it has evolved to include 30 of the most influential and well-known publicly traded corporations in the United States. This index serves as a critical barometer for the overall performance of the U.S. stock market, offering valuable insights into market trends and economic stability.

On December 29, 2025, the DJIA continues to be a focal point for investors, serving as a key benchmark for assessing market performance. The index is composed of 30 blue-chip companies, which are widely recognized for their financial stability and market influence. These companies span various sectors, including technology, finance, healthcare, and consumer goods, providing a comprehensive view of the broader economy. The DJIA's performance is closely monitored by investors, economists, and policymakers, who use it to gauge the health of the U.S. economy and make informed investment decisions.

In addition to the DJIA, other significant market indices, such as the S&P 500 and the Nasdaq Composite, are also crucial for understanding the overall market landscape. The S&P 500 comprises 500 leading companies from various industries, offering a broader scope of the market's performance. The Nasdaq Composite, on the other hand, is heavily weighted towards technology and growth-oriented companies, making it a key indicator for the tech sector. Both indices provide valuable insights into different segments of the market, allowing investors to diversify their portfolios and make strategic investment decisions.

The DJIA futures and Nasdaq futures also play a crucial role in the trading landscape. Futures contracts allow traders to speculate on the future price movements of the DJIA and Nasdaq, providing a mechanism for hedging and risk management. These derivatives are actively traded on exchanges and can offer early indications of market sentiment and future performance. Monitoring these futures can help investors anticipate market trends and adjust their strategies accordingly, making them an essential tool for both short-term and long-term investment planning.

Today, the DJIA's performance is a reflection of broader economic trends and market sentiment. Despite volatility, the DJIA has shown resilience, demonstrating the strength of the U.S. economy and the resilience of its leading companies. As the year 2025 draws to a close, investors are closely watching the DJIA for indications of future market movements and economic stability.

In conclusion, the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite each offer unique perspectives on the U.S. stock market. As key benchmarks, they provide investors with the insights needed to navigate market fluctuations and make informed decisions. By understanding the differences and strengths of each index, investors can better position themselves for success in a dynamic and ever-changing market environment.