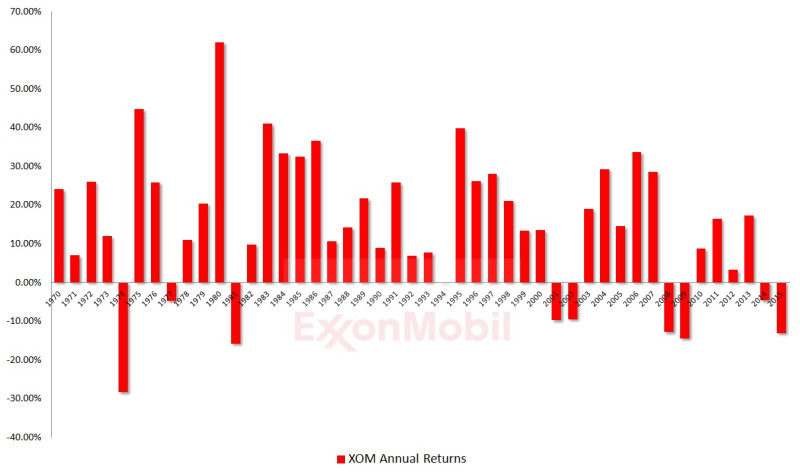

Exxon Mobil Corporation (XOM) continues to be a leader in the energy sector, capturing the attention of investors and analysts alike. As of January 3, 2026, the stock has shown considerable volatility, reflecting the broader market trends and industry-specific challenges. This article provides a comprehensive analysis of the current state of Exxon Mobil stock (XOM), examining recent performance, key factors influencing its price, and what investors should consider before making decisions.

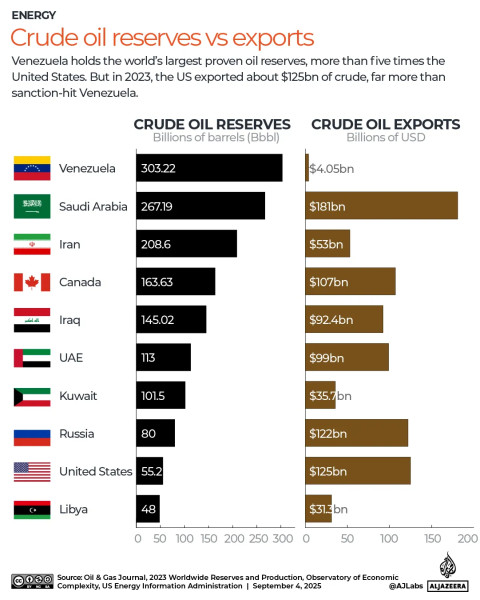

Exxon Mobil Corporation, a titan in the oil and gas industry, has a storied history dating back to the early 20th century. The company's robust portfolio of refining, chemical, and upstream operations positions it as a dominant player in the global energy market. As of now, the stock price of XOM is subject to various market dynamics, including fluctuations in crude oil prices, regulatory changes, and geopolitical events. According to recent data, the stock has been trading with significant intraday movements, driven by market sentiment and company-specific news.

The company's price has seen notable fluctuations in recent times, with investors closely monitoring the latest developments. As of the latest update, Exxon Mobil's stock price has been influenced by a variety of factors. The company's strong financial performance and strategic initiatives have been key drivers, but external factors, such as global supply and demand dynamics, cannot be overlooked. For instance, a recent surge in oil prices has positively impacted XOM's stock, as higher crude prices typically translate to increased revenue and profitability for the company. However, investors must also consider the risks associated with oil price volatility and potential regulatory hurdles that could affect operations and profitability. The company's commitment to innovation and sustainability is also a significant factor, as it aims to reduce its carbon footprint and invest in renewable energy sources. This long-term strategy not only aligns with global environmental goals but also positions the company for future growth in a more sustainable energy landscape.

The outlook for Exxon Mobil stock remains optimistic, given the company's strong financial health and strategic investments. Recent financial reports indicate a robust balance sheet and steady cash flow, which provide a solid foundation for growth. Additionally, the company's dividend policy, which offers a consistent return to shareholders, continues to be a significant draw for investors. However, the road ahead is not without challenges, as the energy sector faces numerous uncertainties, including regulatory pressures and market volatility. As such, investors must remain vigilant and informed, keeping a close eye on industry trends and company developments. The company's ability to navigate these challenges will be critical in determining its future performance and investor sentiment. Overall, while there are risks, the strategic initiatives and financial strength of Exxon Mobil position it well for future growth and continued success in the dynamic energy market. As of now, the stock price of Exxon Mobil stands at a pivotal point, reflecting both opportunities and challenges for investors. The company's resilient performance and strategic vision make it a compelling option for those looking to invest in the energy sector.