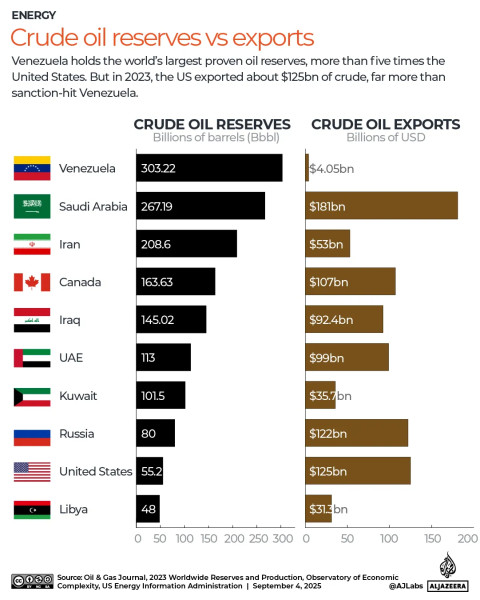

Venezuela, a country rich in natural resources, holds the title of possessing the world's largest proven oil reserves. With approximately 300 billion barrels of oil, the country's petroleum industry is a critical component of its economy and global energy dynamics. However, the **Venezuela oil** industry faces significant hurdles, including mismanagement, lack of investment, and the impact of international sanctions. These challenges have led to a stark contrast between Venezuela's vast reserves and its actual crude output, which remains at a fraction of its capacity.

Despite these issues, major oil companies like **Chevron** and **Exxon** continue to operate in Venezuela, navigating the complex geopolitical landscape. Chevron, in particular, has shown resilience in maintaining its operations amidst rising U.S. pressure and sanctions, demonstrating the strategic importance of Venezuelan oil to global energy markets. The company's continued presence in Venezuela underscores the country's potential to contribute significantly to global oil supplies if stability can be restored.

The recent geopolitical shifts, including potential policy changes by the U.S. administration, could pave the way for a comeback in Venezuela's oil sector. The easing of sanctions and the resumption of operations by companies like Chevron could mark a turning point, potentially leading to increased oil exports and a more stable energy market. However, the path forward is fraught with uncertainties, as the future of **Venezuela oil** exports will depend on a delicate balance of domestic stability, international relations, and the resilience of oil companies operating in the region.

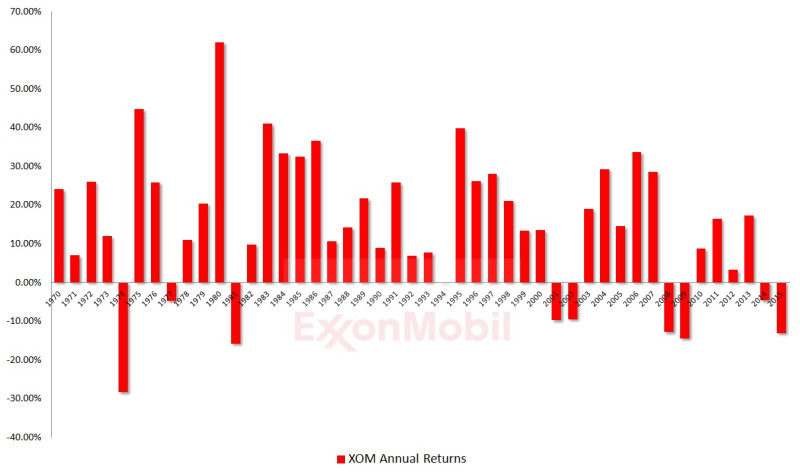

For investors, the volatile situation in Venezuela presents both opportunities and risks. The performance of oil stocks, particularly those of companies like **Chevron** and **Exxon**, is closely tied to the stability and output of Venezuelan oil fields. Recent developments, such as the capture of Venezuelan President Nicolás Maduro, have introduced geopolitical shocks that could impact the energy sector, albeit with limited immediate effects on stock prices. The capture of Maduro by U.S. forces, a significant geopolitical event, has not yet translated into major near-term movements in Chevron stock, indicating a cautious approach by investors.

Looking ahead, the future of **Venezuela's oil** industry hinges on a multitude of factors, including the easing of sanctions, improved domestic management, and the strategic decisions of major oil companies. As the world continues to grapple with energy security and sustainability, Venezuela's role in the global oil market remains a critical area of interest for investors, policymakers, and energy analysts alike. The resilience of companies like Chevron in the face of challenges highlights the enduring importance of Venezuelan oil and the potential for a comeback in the country's oil sector.