The stock market is buzzing with anticipation as investors eagerly await the release of a flurry of bank earnings and economic data, which are expected to shape the trajectory of major indices in the coming days. As of January 15, 2026, Dow Jones futures have slipped, reflecting the cautious sentiment among traders who are navigating through a complex landscape of geopolitical developments and corporate earnings reports.

The Dow Jones Industrial Average (DJIA) has shown signs of volatility, with the index recently experiencing a decline. On Wednesday, January 14, the DJIA lost about 42 points, or around 0.1%, as investors digested a fresh batch of earnings and monitored geopolitical developments.

Stocks moved lower on Wednesday, pulling back further from record levels, a trend that is likely to influence today's trading session. The S&P 500 dropped 0.5% while the Nasdaq Composite shed 1%. This pullback has been attributed to mixed earnings reports and geopolitical tensions, which have created an atmosphere of uncertainty in the market. The Dow Jones futures fell 0.15% vs. fair value, indicating a cautious start to the trading day.

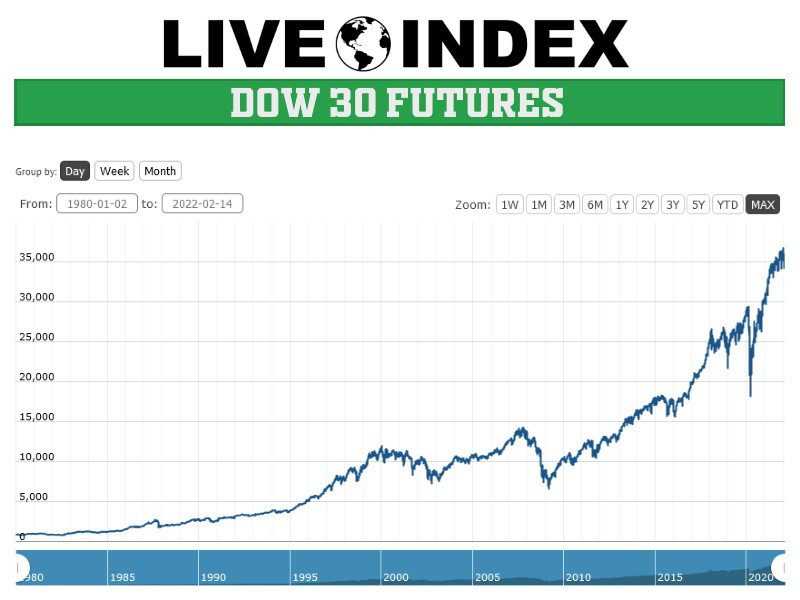

In the premarket trading session, the DJIA futures are being closely watched as they provide early indications of how the market might perform during the regular trading hours. The DJIA futures are based off the Dow 30 stock index, a price-weighted average of 30 significant stocks traded on the New York Stock Exchange (NYSE), offering a snapshot of the broader market sentiment.

Market analysts are also keeping a close eye on the tech sector, which has been a significant driver of market movements in recent months. The Nasdaq 100 futures have seen some volatility, with Google and other AI-related stocks leading the charge in terms of buy zones. This sector's performance is crucial for the overall market sentiment, as tech stocks often dictate the direction of broader indices.

In addition to the earnings reports, investors are also focused on the latest economic data, which is expected to provide further clarity on the state of the economy. Safe-haven assets like gold and silver have surged to fresh record highs, a clear indication of the market's risk aversion.

As the market awaits these key developments, traders are advised to stay vigilant and adapt their strategies accordingly. The stock market is inherently unpredictable, and today's session is likely to be no exception. Investors should be prepared for potential volatility and remain flexible in their approach to navigate the market's ever-changing landscape.