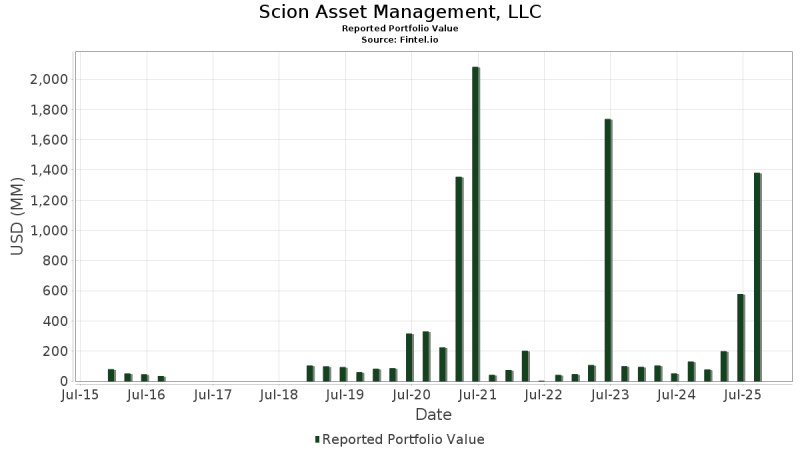

The story of Michael Burry and his hedge fund, Scion Asset Management, is one that has captivated the financial world for over a decade. Known for his prescient prediction of the 2008 financial crisis, Burry managed to achieve remarkable returns at Scion, particularly in the tumultuous years of 2007 and 2008 when the fund posted gains of over 500% and nearly 90%, respectively.

However, after the crisis, maintaining such high levels of performance became increasingly challenging. Burry's decision to significantly reduce the size of Scion in response to market changes and personal burnout marked a turning point for both him and his fund. In 2013, he officially stepped down from managing Scion, leaving behind a legacy that continues to influence investment strategies today.

Burry's unique approach to investing—often characterized by contrarian bets against popular trends—highlighted his deep understanding of financial markets and ability to identify systemic risks. His experiences at Scion are chronicled in Michael Lewis’s book "The Big Short," which brought Burry's story to a wider audience.

Despite stepping away from active management, Burry remains an influential figure within investment circles, offering insights into economic trends and market dynamics that continue to be closely watched. As the financial landscape evolves, his legacy at Scion Asset Management serves as both a cautionary tale and a beacon of analytical prowess.

Reflecting on Burry's journey with Scion prompts questions about the sustainability of high-risk, high-reward strategies in volatile markets.