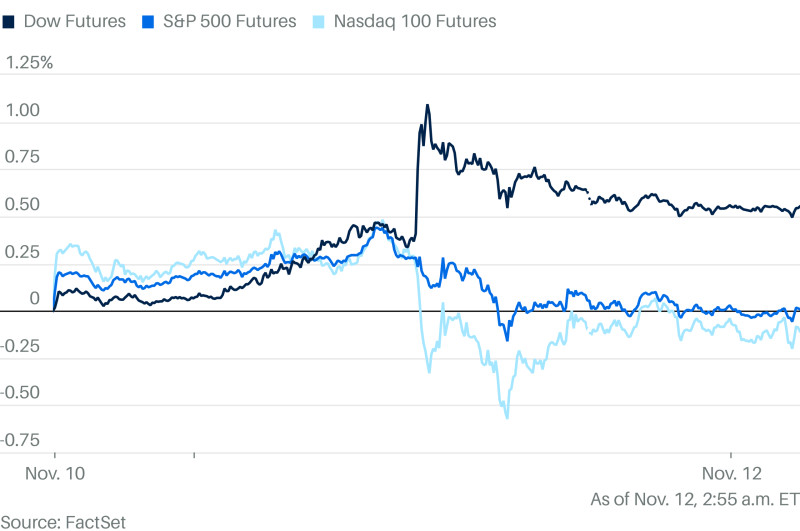

The US stock market took a significant hit today, with the Dow Jones Industrial Average falling sharply and dragging other major indices into negative territory. The Dow dropped 382 points, marking its biggest daily decline since October . This downturn was not isolated to just one index; the S&P 500 also saw a notable dip of around 1.7%, while the Nasdaq Composite fell by 2.3% .

The reasons behind this market volatility are multifaceted, but primarily stem from concerns over missing economic data following the six-week government shutdown. Investors were particularly anxious about upcoming inflation and jobs reports that could provide crucial insights into the state of the economy . The reopening of the federal government has not alleviated these worries; instead, it has intensified them as traders now have a clearer view of what they've been missing.

Among the tech giants, Nvidia saw its stock price drop significantly, contributing to the overall decline in the Nasdaq. Similarly, other major players like Broadcom and Alphabet also experienced losses . Disney's shares sank by 9% after reporting weak revenue figures, adding fuel to the fire of market pessimism .

Adding to the unease was a rise in Treasury yields, which often signals that investors are seeking safer assets amid economic uncertainty. This shift towards value stocks over growth stocks further exacerbated the sell-off across various sectors .

The broader implications of today's market performance could be significant for both short-term and long-term investment strategies. As volatility increases, traders will likely continue to rotate into more stable investments until clearer economic indicators emerge.

Stay tuned as we monitor these developments closely and provide updates on any new information that may impact the stock market in the coming days .