The Internal Revenue Service (IRS) periodically updates the contribution limits for retirement plans like the 401(k). For 2026, these limits are set to ensure that individuals can save adequately for their future while maintaining tax efficiency. As of now, the maximum amount an individual can contribute to a 401(k) plan in 2026 is expected to increase slightly from previous years.

For 2026, the IRS has announced that employees will be able to contribute up to $23,500 into their 401(k) plans. This figure represents a modest rise compared to the limits set for earlier years and reflects the ongoing adjustments made by the government to keep pace with inflation and economic conditions.

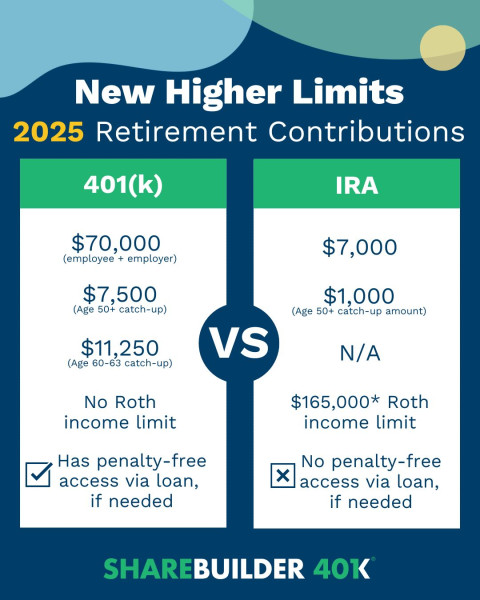

In addition to the regular contribution limit, individuals aged 50 or older are eligible for catch-up contributions. For 2026, this additional amount is expected to be $7,500, bringing their total possible annual contribution up to $31,000. These catch-up provisions aim to help older workers who may need to save more aggressively in the final years before retirement.

It's important for employees to understand that these limits apply only to elective deferrals—money they choose to put into their 401(k) accounts—and do not include employer contributions. Employers can contribute additional funds on behalf of their employees, but these are subject to separate IRS guidelines and may vary based on the specific plan design.

Employer matching contributions also play a significant role in maximizing retirement savings. While there is no set limit for how much an employer can match, most plans have some form of formula that determines the amount matched based on employee contributions. For example, an employer might match 50 cents for every dollar contributed up to a certain percentage of the employee's salary.

Understanding these limits and contribution strategies is crucial for anyone looking to maximize their retirement savings in 2026. By contributing the maximum allowable amount and taking advantage of any available catch-up contributions, individuals can build a robust nest egg that will provide financial security during their golden years.

The IRS updates these limits annually based on changes in the cost of living and other economic factors. As such, it's important for employees to stay informed about any adjustments made each year to ensure they are making the most of their retirement savings opportunities.