The cryptocurrency world is reeling today, with Bitcoin's value plummeting to its lowest point in years . The once-mighty digital currency has been on a downward spiral since the beginning of this year, but today’s crash feels like a final nail in the coffin for many investors who have held onto their BTC dreams. As the price hovers around $8,000 per coin, it's clear that the speculative bubble is finally bursting .

Analysts are quick to point fingers at regulatory crackdowns and increased competition from newer cryptocurrencies like Ethereum and Solana . But let’s be real—this isn’t just about market forces. It’s about a collective loss of faith in an idea that once seemed revolutionary but now feels as outdated as dial-up internet.

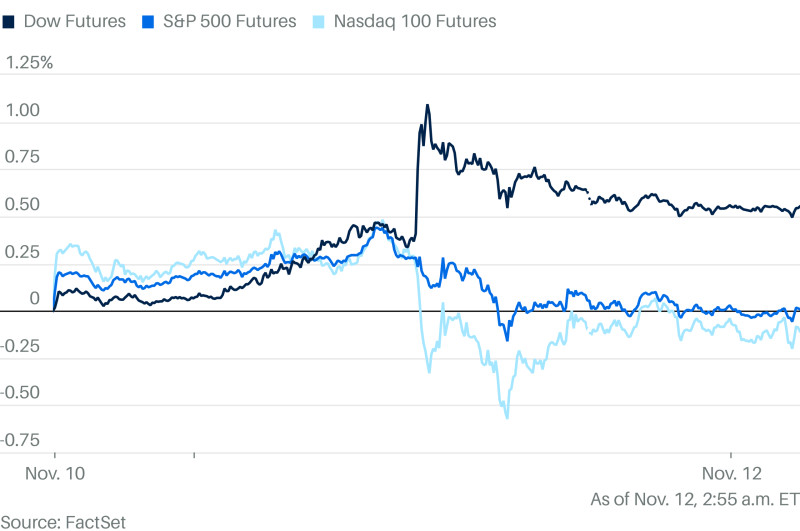

Meanwhile, the rest of the financial world is watching with a mix of schadenfreude and caution. The stock markets are up today, with tech stocks leading the charge . It’s almost as if they’re saying, “See? We told you so.” But don’t be fooled—this isn’t just about Bitcoin. It’s about the entire speculative economy that has been built on quicksand.

The irony is palpable: while Bitcoin was once hailed as a decentralized alternative to traditional banking systems, it's now more intertwined with those very institutions than ever before . The dream of financial freedom through digital currency seems to have turned into a nightmare for many investors who are now facing significant losses. And let’s not forget the environmental impact—Bitcoin mining consumes vast amounts of energy, contributing significantly to global carbon emissions .

So what does this mean for the future? Will Bitcoin bounce back like it did in previous crashes, or is this the beginning of a long-term decline? The optimists will tell you that every crash presents an opportunity to buy low and sell high. But let’s be honest—this isn’t about buying low anymore; it’s about cutting your losses before they become irreparable.

As for me, I’m taking this as a sign to reassess my financial priorities. Maybe it's time to move away from speculative investments and focus on more stable, sustainable options. After all, the real world doesn’t run on dreams—it runs on cold, hard cash.

In the meantime, keep an eye on those other cryptocurrencies. While Bitcoin may be crashing, there are always new players ready to take its place at the top of the speculative pyramid . But remember—just because something is shiny and new doesn't mean it’s a good investment. The market can be as fickle as a teenager with mood swings.

So here's to hoping that this crash serves as a wake-up call for everyone involved in the crypto world. Maybe, just maybe, we’ll start seeing more responsible investments and less speculation. But don’t hold your breath—I have a feeling it’s going to be a bumpy ride from here on out.

Stay tuned, because one thing is certain: the story of Bitcoin isn't over yet. It's just entering its next chapter—one that may not end happily ever after for many investors .

--- Current date & time in ISO format (UTC timezone) is: 2025-11-14T00:10:45.310Z. Bitcoin's value has been on a steady decline since the beginning of this year, with today’s crash marking its lowest point in years. Regulatory crackdowns and increased competition from newer cryptocurrencies like Ethereum and Solana are cited as major factors contributing to Bitcoin's downfall. The stock markets are up today, particularly tech stocks, which seem to be benefiting from the crypto market's downturn. Despite being a decentralized currency, Bitcoin has become increasingly intertwined with traditional financial institutions. Bitcoin mining consumes vast amounts of energy, significantly contributing to global carbon emissions. While Bitcoin may be crashing, other cryptocurrencies are emerging as potential alternatives for speculative investments. The future of Bitcoin remains uncertain, but its current crash serves as a significant turning point in the cryptocurrency market.