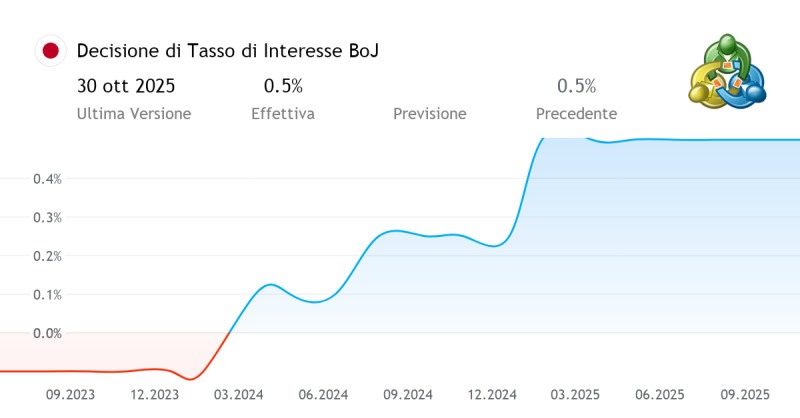

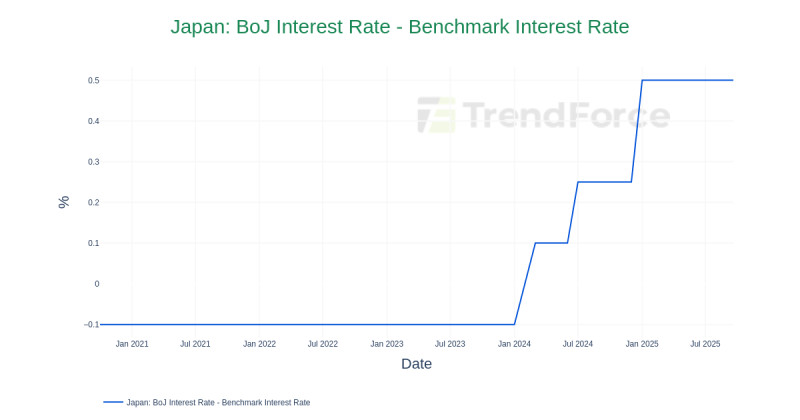

The Bank of Japan (BOJ) has taken a monumental step by raising its key policy rate to 0.75%, marking the highest level since September 1995. This decision, made during the early hours of December 19, 2025, was widely anticipated by investors and economists alike, reflecting a significant shift in the central bank's monetary policy.

The hike, which was unanimously agreed upon by the BOJ's policymakers, was accompanied by a clear signal that more rate increases are on the horizon, as the central bank aims to "normalize" its monetary policy after decades of ultra-loose measures. Governor Kazuo Ueda is expected to provide further insights into the BOJ's future plans during a press conference later today, scheduled for 06:30 GMT.

Investors have been bracing for this move, which is expected to strengthen the yen against the dollar. Higher interest rates typically attract investments seeking higher yields, leading to an appreciation of the domestic currency. This move will also increase the cost of servicing Japan's substantial public debt, which is the highest among developed economies.

The decision comes after extensive market speculation and data analysis, with an 86.4% probability of a rate hike as indicated by data from LSEG. This move underscores the BOJ's gradual shift away from the ultra-easy monetary policy that has been in place for many years, a policy that has been instrumental in supporting the Japanese economy through various challenges.

Governor Kazuo Ueda's leadership has been pivotal in guiding the BOJ through this transition. His press conference later today will be closely watched as markets seek clarity on the future trajectory of Japanese monetary policy and its implications for global financial markets.

As the dust settles on this historic decision, the financial world will be eagerly awaiting the next steps from the BOJ and the potential ripple effects on the global economy. This rate hike is not just a number but a symbol of Japan's evolving economic landscape and the BOJ's commitment to steering the country towards a more sustainable financial future.