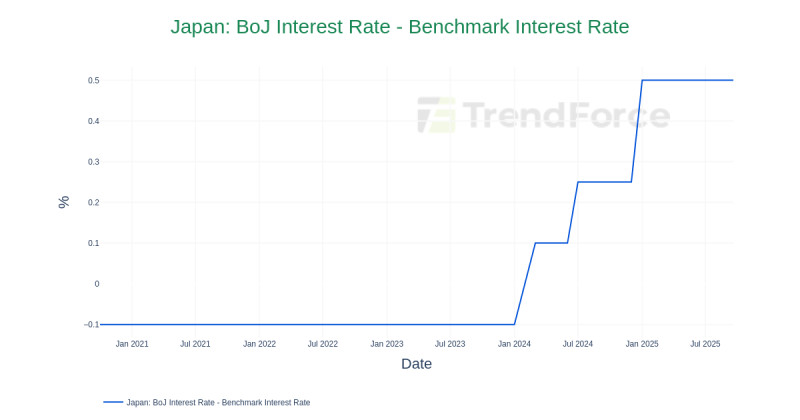

The Bank of Japan (BOJ) has recently stirred the financial markets by raising its key short-term interest rate to 0.75% during its December meeting, marking a significant shift in monetary policy. This decision, the highest interest rate since 1995, is set to have far-reaching implications for the Japanese economy and, more importantly, for the USD to JPY exchange rate.

The BOJ's rate decision is a pivotal moment, especially when viewed against the backdrop of global monetary policy trends. While other major central banks are lowering interest rates to stimulate their economies, the BOJ has taken a divergent path. This shift could be attributed to Japan's persistent battle with inflation and a sluggish economic recovery. The rate hike is expected to stabilize the yen, which has been weakened by the broader economic conditions and the divergence in global monetary policies.

Analysts and traders are closely monitoring the USD to JPY exchange rate in the wake of this decision. The yen has seen a sharp decline, hitting record lows against the euro and other major currencies. The rate hike by the BOJ is anticipated to provide some support to the yen, potentially leading to a stabilization or even a strengthening of the currency. However, the immediate impact has been a further weakening of the yen, indicating that market participants are uncertain about the long-term effects of the rate hike.

The BOJ's decision to raise interest rates reflects a broader shift in its monetary policy stance. For years, the BOJ has maintained near-zero or negative interest rates to bolster the economy, but the latest move signals a departure from this strategy. The central bank's decision to increase the interest rate to 0.75% is a response to rising inflationary pressures and a desire to stabilize the economy. This move is expected to have a ripple effect on the USD to JPY exchange rate, as higher interest rates generally make a currency more attractive to foreign investors, leading to increased demand and a potential strengthening of the yen.

The future outlook for the USD to JPY exchange rate remains uncertain, but one thing is clear: the BOJ's rate decision is a game-changer. The central bank has signaled that more hikes are likely in the pipeline, which could further influence the currency markets. As the world's third-largest economy, Japan's monetary policy decisions carry significant weight, and the effects of the rate hike will be closely monitored by economists, traders, and policymakers alike.