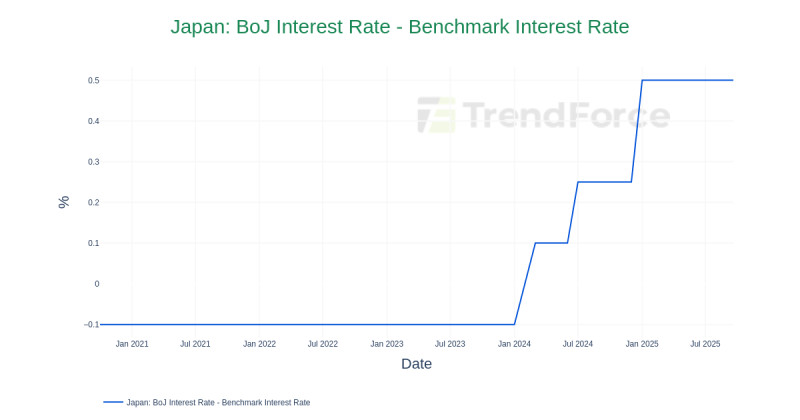

On December 19, 2025, the Bank of Japan made a significant interest rate announcement, raising its key short-term interest rate by 25 basis points to 0.75%, marking the highest level since September 1995 . This decision has had a profound impact on the USD/JPY exchange rate, with the Japanese Yen sliding sharply against the US Dollar .

The Bank of Japan's decision to raise the interest rate by 25 basis points to 0.75% is a strategic move that has significant implications for the forex market. The Bank of Japan (BOJ) had maintained interest rates near or below zero for an extended period to stimulate the economy . However, the recent hike signals a shift in monetary policy, aimed at addressing inflationary pressures and stabilizing the economy .

The Bank of Japan also indicated that while further rate hikes are expected, they are not imminent . This cautious approach suggests that the BOJ is closely monitoring economic indicators and is prepared to adjust its policy as needed. The decision to raise rates was unanimous, reflecting a consensus among policy board members on the direction of monetary policy .

The reaction from investors has been mixed. On one hand, the rate hike has pushed the Japanese Yen lower, benefiting carry traders who short the yen to invest in higher-yielding assets . On the other hand, the USD/JPY exchange rate has seen a significant jump, reaching a one-month high as the yen weakens across the board .

This BOJ rate decision has far-reaching implications for the global forex market and the broader economy. As the Bank of Japan continues to navigate the complexities of monetary policy, the USD/JPY exchange rate will remain a key indicator of economic health and investor sentiment. For now, traders and investors are closely watching for any further signals from the BOJ, which could influence future movements in the USD/JPY exchange rate .