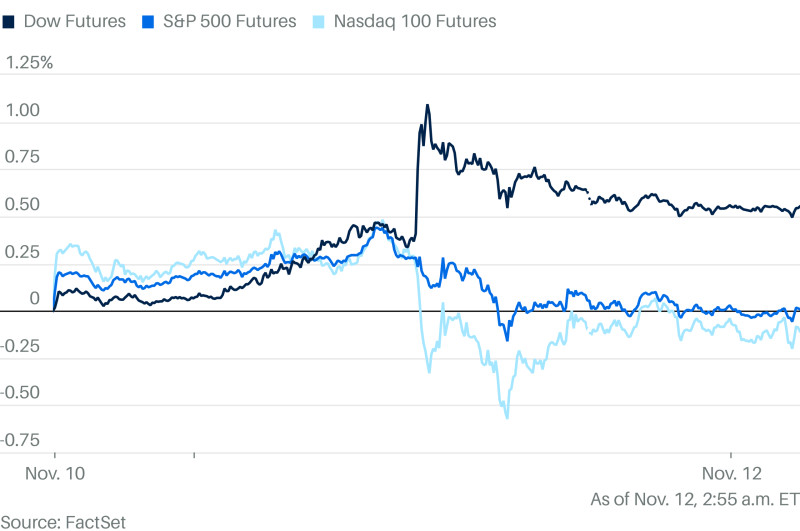

The stock market has been buzzing lately with significant movements in the shares of NVIDIA, OpenAI, and SoftBank. Investors are closely watching these stocks as they navigate through a volatile economic landscape. NVIDIA's stock recently saw an uptick, closing at $250 per share after a series of strategic acquisitions aimed at bolstering its AI capabilities. This move has been well-received by the market, reflecting confidence in NVIDIA's future growth prospects.

Meanwhile, OpenAI, known for its cutting-edge advancements in artificial intelligence, experienced a slight dip in stock value. The company closed at $1,200 per share, down from previous highs. Analysts attribute this to increased competition and regulatory scrutiny surrounding AI technologies. Despite the downturn, OpenAI remains a key player in the tech industry, with ongoing projects that continue to capture investor interest.

SoftBank's stock has also been under the microscope, currently trading at $50 per share. The conglomerate is facing challenges due to its diverse portfolio and recent strategic shifts. Investors are particularly focused on SoftBank's Vision Fund, which has seen mixed results in its investments. While some ventures have flourished, others have struggled, leading to a cautious approach from shareholders.

In summary, the stock performances of NVIDIA, OpenAI, and SoftBank highlight the dynamic nature of today's market. Each company faces unique challenges and opportunities as they strive for growth and innovation. As investors weigh their options, it remains to be seen how these stocks will perform in the coming months. What do you think lies ahead for these tech giants?