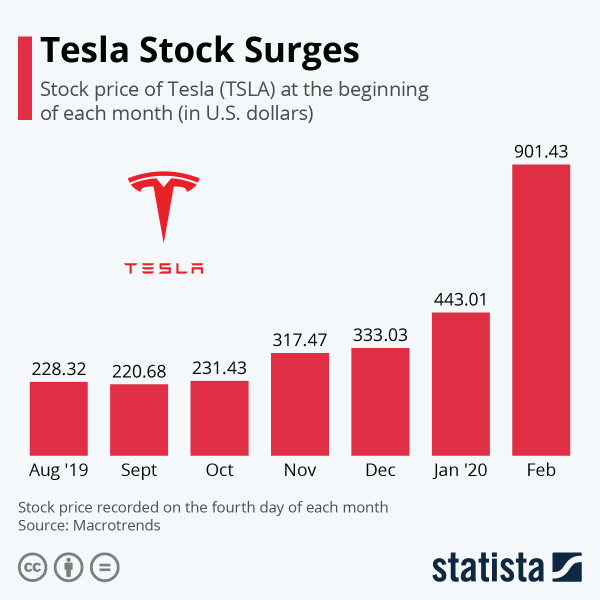

The rise of electric vehicles (EVs) has sparked significant interest in the stock market, with Tesla stock (TSLA) being a focal point for investors. On January 3, 2026, at 4:05 AM UTC, Tesla, Inc. continues to make headlines with its dynamic performance and innovative strides in the automotive and clean energy sectors. Investors are closely monitoring the latest stock price and news, seeking to capitalize on the fluctuations and long-term trends of TSLA.

Tesla's stock price has been a rollercoaster, reflecting both the excitement and the volatility typical of a high-growth company in a rapidly evolving industry. The latest stock quote, historical performance, and financial information are crucial for making informed trading and investment decisions. On platforms like Yahoo Finance, Google Finance, and CNBC, investors can access real-time stock prices and comprehensive analyses to navigate the complex landscape of TSLA stock. For instance, CNBC provides real-time stock quotes, news, and financial information, making it a go-to resource for immediate updates.

For those keen on a detailed overview, Yahoo Finance offers a wealth of data, including stock quotes, historical performance, news, and other vital information, which are essential for understanding the stock's trajectory and potential future movements. Similarly, MarketWatch delivers real-time stock prices and quotes, providing a full financial overview that helps investors stay ahead of the curve.

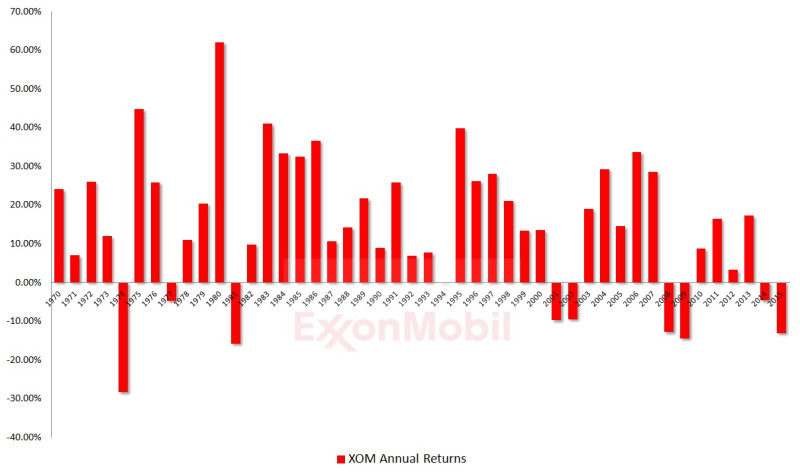

Historical data is equally important for understanding the trends and cycles that TSLA has undergone. Since 2010, Tesla's stock has seen significant milestones, including price targets, splits, and performance comparisons to indexes and ETFs. This historical data, available on platforms like Bloomberg and The Economic Times, offers valuable insights into the stock's behavior over time, aiding in the prediction of future performance.

Tesla's innovative approach to electric vehicles and clean energy solutions has positioned it as a leader in the industry. The company's focus on sustainability and technological advancement has captured the attention of investors worldwide. As Tesla continues to expand its product offerings and market reach, the volatility in its stock price is expected to persist, driven by factors such as market sentiment, regulatory changes, and competitive dynamics. Platforms like Barchart.com and WSJ provide in-depth analysis and opinions, catering to those who seek a deeper understanding of the company's prospects and the factors influencing its stock price.

In conclusion, Tesla stock remains a compelling investment opportunity despite its inherent volatility. By leveraging the insights from various financial platforms and staying updated with the latest news and analyses, investors can navigate the complexities of TSLA stock and make informed decisions. Whether you are a seasoned investor or a newcomer to the stock market, keeping a close eye on Tesla's performance and market trends will be crucial for capitalizing on the opportunities that lie ahead.